Key Points:

-

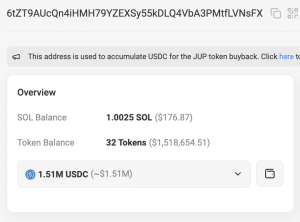

Massive $JUP Buybacks

Jupiter is allocating 50% of protocol fees to buy back and lock $JUP for 3 years, creating strong long-term demand.

-

$100M+ Annual Buybacks

Research estimates Jupiter will buy back over $100M worth of $JUP annually, reinforcing token value and stability.

-

Revenue-Powered Growth

Jupiter generates millions daily from Perps, DCA, and Ultra Mode, ensuring continuous funding for buybacks.